No gender gap in Australian student financial literacy: PISA

Media release 21 Jul 2020 8 minute readAustralia has closed the gender gap in its teenagers’ financial literacy achievement that was identified five years ago, when Australian girls were outperforming Australian boys, according to a report released today by the Australian Council for Educational Research (ACER).

ACER’s report analyses Australian student achievement and questionnaire responses in the latest OECD Programme for International Student Assessment (PISA) Financial Literacy survey. Conducted every three years since 2012, the survey measures 15-year-olds’ knowledge of personal finances and their ability to apply this knowledge to financial problems. ACER’s report places a national lens over the 2018 survey results released by the OECD in May.

ACER Deputy CEO (Research) Dr Sue Thomson said students’ financial literacy depended in part on their overall mathematical and reading literacy.

“On average, across the OECD and within Australia, around 20 per cent of the financial literacy score reflected factors that were uniquely captured by the financial literacy assessment, while the remaining 80 per cent reflected skills in mathematical or reading literacy,” Dr Thomson said.

“While Australian girls outperformed boys in the 2018 PISA reading literacy assessment, and boys outperformed girls in mathematical literacy, it is encouraging to see that there is no gender gap in the financial literacy of Australia’s 15-year-olds.”

Dr Thomson noted that, while there were no gender differences in Australian student’s financial literacy achievement, there were gender differences in their financial experiences and attitudes. More Australian boys reported that they enjoy talking about money matters, while more Australian girls believed money matters are not personally relevant at the moment.

Australian girls reported lower exposure than boys to financial education in school and in activities outside school. A higher percentage of Australian boys reported that they obtained information about money matters from their teachers, friends, television or radio, the internet and magazines, while more girls reported obtaining information about money matters from their parents.

20 countries, 117000 students worldwide, 9411 Australian students, 740 Australian schools.

Australia’s average student achievement was below that of four other countries.

Number of countries at a similar level to Australia = 2.

Number of countries significantly lower than Australia = 13.

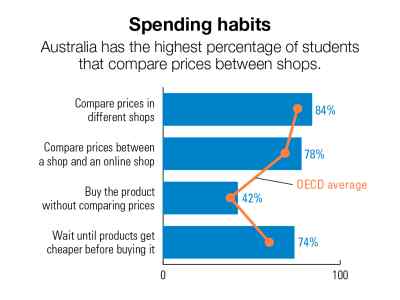

Australia has the highest percentage of students that compare prices between shops.

84% of Australian students compare prices in difference shops (OECD average 76%).

78% of Australian students compare prices between a shop and an online shop (OECD average 69%).

42% of Australian students buy the product without comparing prices (OECD average 38%).

74% of Australian students wait until the products get cheaper before buying (OECD average 60%).

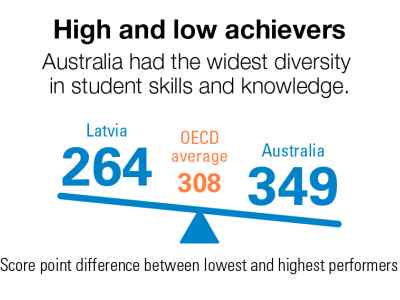

Australia had the widest diversity in student skills and knowledge.

The score point difference between Australia’s highest and lower performers was 349 points.

The smallest difference was found in Latvia, where 264 points separated their highest and lowest performers.

The OECD average score point difference between highest and lowest performers was 308 points.

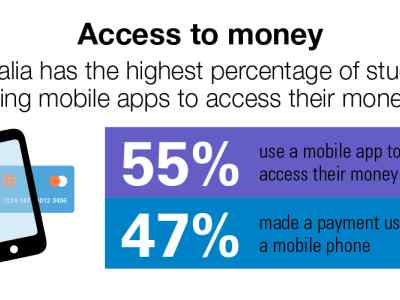

Australia has the highest percentage of students using mobile apps to access their money.

55% of Australian students use a mobile app to access their money.

47% of Australian students have made a payment using a mobile phone.

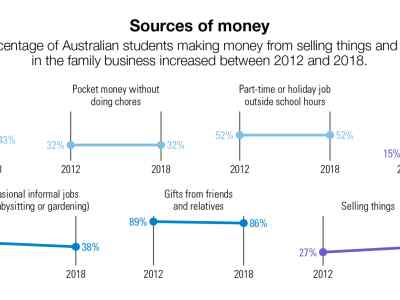

The percentage of Australian students making money from selling things increased from 27% in 2012 to 37% in 2018.

The percentage of Australian students making money from working in the family business increased from 15% in 2012 to 19% in 2018.

The percentage of Australian students receiving pocket money for doing chores at home was 44% in 2012 and 43% in 2018.

The percentage of Australian students receiving pocket money without doing chores was 32% in 2012 and 32% in 2018.

The percentage of Australian students receiving pocket money from a part-time or holiday job outside of school hours was 52% in 2012 and 52% in 2018.

The percentage of Australian students making money from occasional informal jobs (e.g. babysitting or gardening) decreased from 46% in 2012 to 38% in 2018.

The percentage of Australian students receiving money as gifts from relatives or friends decreased from 89% in 2012 to 86% in 2018.

View the infographic as a single image.

ACER’s report on Australia’s PISA 2018 Financial Literacy survey results also reveals:

- Australian students had the fourth highest exposure to financial education in school, behind Indonesia, Finland and the Russian Federation.

- Australia had the largest performance difference between its highest and lowest achievers, at 349 points compared to the OECD average of 308 points.

- Eighty per cent of students in the highest quartile of socioeconomic background achieved the national proficient standard, compared to 47 per cent of those in the lowest quartile.

- Australia had the highest percentage of students using a mobile app to access their money (55 per cent), ahead of the Russian Federation (50 per cent) and Canada (46 per cent).

Australia’s participation in the PISA 2018 Financial Literacy survey was managed by ACER and conducted with funding from the Australian Securities and Investments Commission (ASIC) as the Australian Government agency responsible for financial literacy. A total of 117 000 students from 20 economies participated in the financial literacy survey, including 9411 Australian students from 740 schools.

PISA 2018: Financial literacy in Australia by Sue Thomson, Lisa De Bortoli, Catherine Underwood and Marina Schmid (ACER, 2020) is available from < www.acer.org/ozpisa >

Media enquiries:

ACER corporate communications

+61 419 340 058

communications@acer.org