Australian teens show financial nous: PISA

Research 10 Jul 2014 5 minute readAustralian students rank in the top five in the world’s first international assessment of young people’s financial literacy, according to the latest PISA report by Sue Thomson.

Australian teens show financial nous: PISA

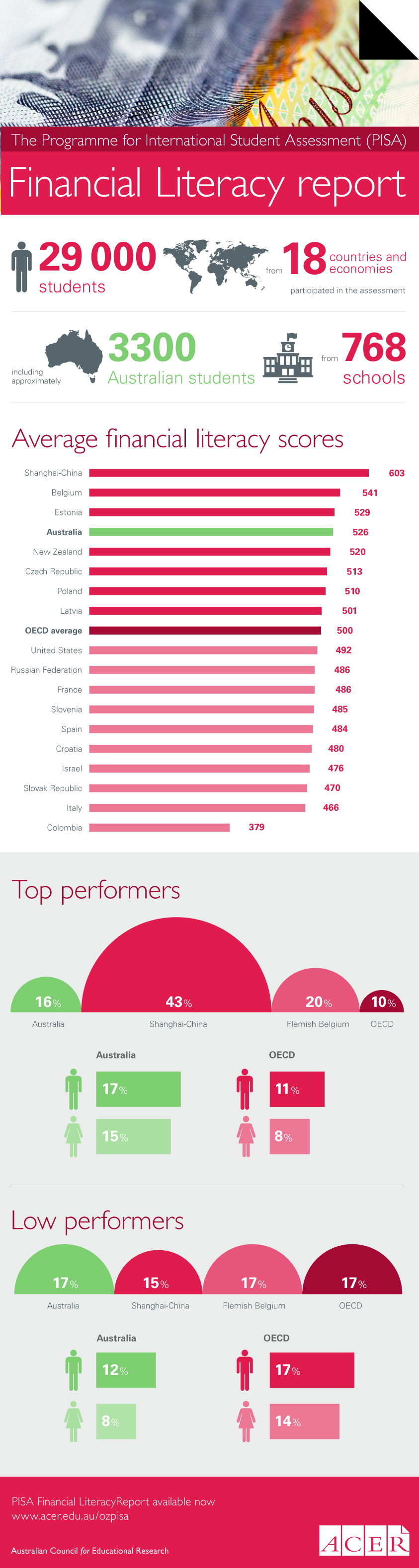

Conducted in 2012 as part of the Programme for International Student Assessment (PISA) of the OECD with support from the Australian Securities and Investments Commission as the Australian Government agency responsible for financial literacy, the supplementary PISA financial literacy assessment measured 15-year-olds’ knowledge of personal finances and ability to apply it to financial problems. A total of 29 000 students from 18 countries and economies participated in the assessment, including approximately 3300 Australian students from 768 schools.

The report, Financing the Future: Australian students’ results in the PISA 2012 Financial Literacy assessment, from the Australian Council for Educational Research (ACER) reveals that Australian students achieved an average score of 526 points, significantly above the OECD average of 500 points.

Australia equal third

|

| PISA 2012 financial literacy infographic |

After accounting for non-significant differences between countries and economies, Australia performed equal third, behind Shanghai-China, with an average score of 603 points, and the Flemish community of Belgium, with an average score of 541 points. Estonia and New Zealand performed at a similar level to Australia, with average scores of 529 and 520 points respectively.

Almost 90 per cent of Australian students met or exceeded the baseline proficiency at level 2. This is the level of performance that will enable students to actively participate in life situations. The average Australian student achieved at PISA’s proficiency level 3, compared to level 4 in Shanghai-China.

Australia’s performance was significantly higher than the Czech Republic, Poland, Latvia, the United States, the Russian Federation, France, Slovenia, Spain, Croatia, Israel, Slovak Republic, Italy and Colombia.

Sixteen per cent of Australian students were top performers, compared to 43 per cent of students in Shanghai-China, 20 per cent of students in Belgium and 10 per cent of students across the OECD.

Across the 13 participating OECD countries, on average, 85 per cent of students are proficient at or above the level 2 baseline. In other words, more than eight in ten students are able to apply their knowledge to commonly used financial products, terms and concepts.

In five OECD countries and economies, the percentage of students performing at or above level 2 is higher than that OECD average of 85 per cent: 90 per cent of Australian, Czech Republic and Polish students performed at or above level 2, while 91 per cent in Belgium, 95 per cent in Estonia and 98 per cent in Shanghai-China performed at or above level 2.

In 17 out of the 18 participating countries and economies, more than three in four students performed at or above level 2; the exception is Colombia, where 44 per cent of students performed at that level.

The benefit of curriculum and professional development

In the Flemish Community of Belgium, mandatory cross-curricular learning outcomes for secondary schools that came into effect in 2010-11 cover typical financial education topics, such as budgeting, alongside economics topics, such as labour, goods and services, welfare and poverty.

In Shanghai-China, some financial education topics have been integrated into the existing national curriculum since the 1970s, while schools have some autonomy in teaching financial education with respect to the national curriculum.

Australia, Czech Republic, Estonia and New Zealand have all started to develop school curricula for financial literacy, including the development of learning frameworks, while in Australia, Belgium, Czech Republic and New Zealand, professional development for teachers is also available.

More work to be done

While 90 per cent of Australian students performed at or above level 2, there is more work to be done to support the 10 per cent of students that performed below it, and the 19 per cent that performed at the baseline rate.

Australian students in metropolitan schools achieved an average score of 535 points, significantly higher by 32 score points than students in provincial schools and higher by 69 score points than students in remote schools.

In general, the higher the level of a student’s socioeconomic background, the better the student’s performance in financial literacy. Students in the highest socioeconomic quartile achieved an average score of 569 points, 87 score points on average higher than students in the lowest socioeconomic quartile.

There is a significant benefit for young people in being financially literate. From the age of 15, they face important financial decisions, and it is important that they have the higher-order knowledge and skills necessary to make them.

Read the full report:

Financing the Future: Australian students’ results in the PISA 2012 Financial Literacy assessment, by Sue Thomson, is available from the Australian PISA website < www.acer.edu.au/ozpisa >